The Theories of Daniel Kahneman in Behavioral Economics

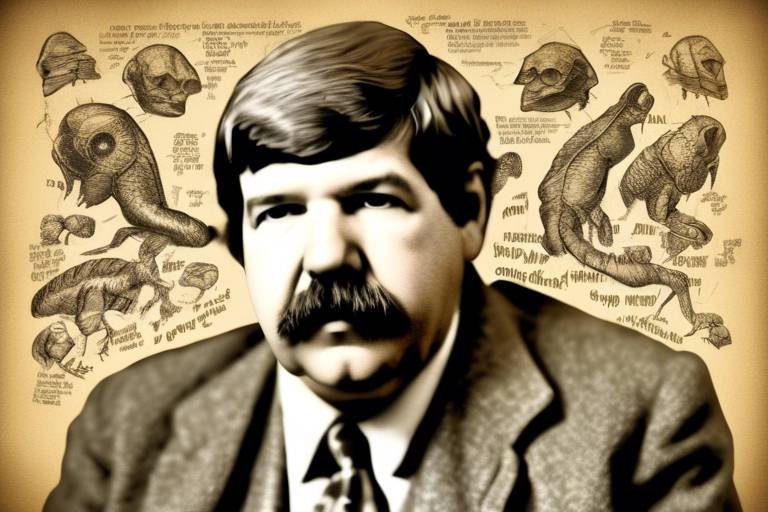

When we think about economics, we often picture graphs, charts, and cold, hard numbers. But what if I told you that the real magic lies in understanding the human mind? Enter Daniel Kahneman, a psychologist turned economist whose groundbreaking work has transformed the way we view decision-making and economic theory. Kahneman, awarded the Nobel Prize in Economic Sciences in 2002, has revealed the intricate ways our cognitive processes can lead us to make irrational choices, often contrary to what traditional economic theory would predict.

His insights challenge the notion of the "rational actor" in economics, suggesting instead that our decisions are heavily influenced by psychological factors. Imagine trying to navigate a maze blindfolded; that's how many of us approach economic decisions without understanding our biases. Kahneman’s theories, particularly around cognitive biases, prospect theory, and overconfidence, serve as a compass to guide us through this complex landscape.

In this article, we'll explore Kahneman's influential theories, diving into the nuances of how they reshape our understanding of human behavior in economic contexts. From the way we perceive losses and gains to how we frame our choices, Kahneman's work provides a lens through which we can better comprehend the often irrational nature of our decisions. Are you ready to unlock the mysteries of your own decision-making processes?

Cognitive biases are like invisible glasses through which we view the world, distorting our perception and leading us astray. These systematic patterns of deviation from norm or rationality in judgment can significantly impact economic decision-making. Kahneman identified numerous cognitive biases that affect our choices, such as the anchoring effect, where we rely too heavily on the first piece of information we receive, or confirmation bias, where we favor information that confirms our pre-existing beliefs.

Understanding these biases is crucial because they can lead to poor financial decisions, misguided investments, and even flawed business strategies. For instance, a consumer might anchor their perception of a product's value based on an inflated initial price, leading them to believe they're getting a bargain when, in reality, they might be overpaying. The implications of these biases stretch far and wide, influencing everything from personal finance to global markets.

Now, let’s dive into one of Kahneman's most significant contributions: Prospect Theory. Developed alongside his colleague Amos Tversky, this theory describes how people make decisions involving risk and uncertainty. Unlike traditional utility theory, which assumes individuals act rationally to maximize utility, Prospect Theory reveals that we often evaluate potential losses and gains differently.

At the heart of Prospect Theory is the concept of loss aversion. This principle suggests that the pain of losing is psychologically more impactful than the pleasure of gaining an equivalent amount. For example, losing $100 feels much worse than the joy of gaining $100 feels good. This asymmetry in our emotional responses can lead us to make decisions that favor avoiding losses over acquiring gains, which can be a double-edged sword in consumer behavior and investment decisions.

Marketers have harnessed the power of loss aversion to craft compelling strategies that can influence consumer choices. By emphasizing potential losses—like missing out on a limited-time offer or the risk of not upgrading to a new product—marketers can create a sense of urgency that drives purchases. For instance, a campaign highlighting how much consumers could lose by not acting quickly can be more effective than one simply showcasing benefits.

Loss aversion also plays a crucial role in the financial markets. Investors may hold onto losing stocks in the hope of recovering their initial investment, rather than making rational decisions based on current market conditions. This behavior can lead to significant financial losses over time. Case studies have shown that understanding loss aversion can help investors make more informed choices, ultimately leading to better financial outcomes.

Another fascinating aspect of Kahneman's work is the framing effects. This theory illustrates how the presentation of information can significantly influence our decisions. For example, if a medical treatment has a 90% success rate, people are more likely to opt for it than if they learn it has a 10% failure rate, even though both statements convey the same information. This highlights the importance of context in decision-making and how subtle changes in wording can lead to drastically different choices.

Now, let’s tackle the overconfidence bias, which often leads individuals to overestimate their knowledge and abilities. This bias can be particularly detrimental in business settings, where leaders may make bold decisions based on inflated self-assessments. Entrepreneurs, in particular, are notorious for their overconfidence, believing they can predict market trends or outsmart competitors.

While a certain level of confidence is essential for entrepreneurs, striking a balance between confidence and caution is crucial. Overconfidence can lead to poor risk assessments, unrealistic expectations, and ultimately, business failures. It’s like sailing a ship; too much wind can capsize the vessel, while too little can leave it stranded. Entrepreneurs must learn to harness their confidence while remaining grounded in reality.

Recognizing and mitigating overconfidence is vital for effective decision-making. One strategy is to seek feedback from peers or mentors, which can provide a more balanced perspective. Additionally, conducting thorough research and analysis before making decisions can help ground entrepreneurs in reality, allowing them to make more informed choices. By fostering a culture of critical thinking and humility, individuals can navigate the complexities of risk and opportunity with greater clarity.

- What is Daniel Kahneman known for?

Kahneman is known for his work in behavioral economics, particularly for his theories on cognitive biases and Prospect Theory. - How does loss aversion affect consumer behavior?

Loss aversion leads consumers to prioritize avoiding losses over acquiring equivalent gains, influencing their purchasing decisions. - What are framing effects?

Framing effects refer to how the presentation of information influences decision-making and perceptions of risk and reward. - Why is overconfidence bias problematic for entrepreneurs?

Overconfidence bias can lead to poor risk assessments and unrealistic expectations, which may result in business failures.

Cognitive Biases

Cognitive biases are fascinating quirks of human psychology that can significantly influence our decision-making processes. These biases are systematic patterns where our judgments deviate from rationality, leading us to make choices that might not align with logical reasoning or statistical evidence. Daniel Kahneman, a pioneering figure in behavioral economics, has illuminated various cognitive biases that affect our everyday decisions, often in surprising ways. Understanding these biases is crucial, as they can shape everything from personal finance decisions to large-scale economic trends.

One of the most intriguing aspects of cognitive biases is how they operate beneath the surface of our conscious thought. We often believe we are making rational choices based on solid reasoning, yet numerous studies have shown that our decisions can be swayed by irrelevant factors. For instance, consider the anchoring effect, where individuals rely too heavily on the first piece of information encountered when making decisions. This can lead to skewed perceptions and judgments, particularly in financial contexts, where initial price points can anchor future expectations.

Another notable cognitive bias is the confirmation bias, which causes individuals to favor information that confirms their pre-existing beliefs while disregarding evidence that contradicts them. This bias can create echo chambers, particularly in the age of social media, where users are often exposed only to viewpoints that reinforce their own. In economic terms, this can lead to poor investment decisions as investors cling to their beliefs about a stock or market trend, ignoring contrary data that could inform a more balanced perspective.

Here are a few other cognitive biases identified by Kahneman that play a critical role in decision-making:

- Availability Heuristic: This is when individuals assess the probability of an event based on how easily examples come to mind. For instance, after hearing about a plane crash, a person might overestimate the risks of flying.

- Hindsight Bias: Often referred to as the "I-knew-it-all-along" effect, this bias leads people to see events as having been predictable after they have already occurred, which can distort future decision-making.

- Optimism Bias: This bias leads individuals to believe they are less likely to experience negative events compared to others, which can result in risky financial behaviors.

Understanding these biases is not just an academic exercise; it has real-world implications. For example, in the realm of marketing, businesses can leverage cognitive biases to influence consumer behavior. By presenting information in a way that aligns with these biases, marketers can enhance the appeal of their products or services. This might include emphasizing a product's popularity to tap into the availability heuristic or framing a deal in a way that highlights potential losses rather than gains, capitalizing on loss aversion.

As we navigate a world filled with choices and uncertainties, being aware of cognitive biases can empower us to make more informed decisions. By recognizing the psychological traps that can distort our judgment, we can strive for a more rational approach to decision-making, whether in personal finance, business strategy, or everyday life. In the following sections, we will dive deeper into specific theories and concepts introduced by Kahneman, further unraveling the intricate tapestry of human behavior in economic contexts.

Prospect Theory, a groundbreaking concept developed by Daniel Kahneman and his collaborator Amos Tversky, fundamentally changed the way we understand decision-making under risk. Unlike traditional economic theories that assume individuals behave rationally and make decisions purely based on utility maximization, Prospect Theory introduces a more nuanced view of human behavior. It emphasizes that people often make choices based on perceived gains and losses rather than the final outcomes. In simpler terms, we don't just weigh the end results; we also consider how we feel about potential gains and losses along the way.

At the heart of Prospect Theory are two key components: value function and probability weighting. The value function is typically concave for gains and convex for losses, indicating that we experience diminishing sensitivity to changes in wealth. This means that the difference between gaining $100 and $200 feels less significant than the difference between losing $100 and $200. To illustrate this, consider the following table:

| Outcome | Perceived Value |

|---|---|

| Gain of $100 | Moderate Satisfaction |

| Gain of $200 | High Satisfaction |

| Loss of $100 | High Discomfort |

| Loss of $200 | Extreme Discomfort |

This table emphasizes that while the satisfaction from gains increases, the discomfort from losses escalates even more dramatically. Thus, the pain of losing $100 is often felt more acutely than the pleasure of gaining the same amount, which leads to a phenomenon known as loss aversion. This principle suggests that individuals are more motivated to avoid losses than to achieve equivalent gains, a realization that has profound implications in various fields, especially in economics and marketing.

Moreover, Kahneman and Tversky's work on probability weighting reveals that people do not perceive probabilities linearly. Instead, they tend to overestimate the likelihood of unlikely events and underestimate the likelihood of more probable outcomes. For instance, when faced with a lottery ticket, many individuals might perceive a small chance of winning as more significant than it statistically is, leading to irrational buying behaviors. This skewed perception of probability can be pivotal in understanding consumer behavior and investment strategies.

In summary, Prospect Theory provides a more realistic framework for analyzing how people make decisions involving risk. By acknowledging the psychological factors that influence our choices, we can better understand the discrepancies between expected and actual behavior in economic contexts. Whether it's a consumer choosing between products or an investor deciding where to allocate funds, the insights from Prospect Theory reveal the intricate dance between emotion and rationality in our decision-making processes.

Loss Aversion

is a fascinating concept that sits at the heart of Prospect Theory, which was developed by Daniel Kahneman and Amos Tversky. This idea suggests that people experience the pain of losing something much more intensely than the pleasure of gaining something of equal value. In simpler terms, the fear of losing $100 feels much worse than the joy of gaining $100. This psychological quirk has profound implications for how we make decisions in our everyday lives, especially in the realms of consumer behavior and investing.

Imagine you’re at a casino. You’ve just won a small jackpot, and you’re feeling on top of the world. However, as you continue to play, you start losing some of your winnings. The emotional rollercoaster you experience is a perfect illustration of loss aversion. The thrill of your earlier win begins to fade, overshadowed by the anxiety of losing your hard-earned cash. This scenario highlights how our decisions are often driven more by the fear of loss than by the potential for gain.

To understand how loss aversion manifests in real life, consider the following examples:

- When shopping, consumers are often more motivated by the prospect of missing out on a good deal than by the excitement of acquiring a new product.

- In investing, individuals may hold onto losing stocks longer than they should, hoping to avoid the pain of realizing a loss, even when it may be more rational to cut their losses.

The impact of loss aversion can be seen across various sectors, influencing everything from marketing strategies to personal finance decisions. For instance, businesses often leverage this bias by highlighting what customers stand to lose if they don’t act quickly. The classic "limited time offer" is a prime example of how marketers play on our fear of loss to drive sales.

In the investment world, loss aversion can lead to suboptimal financial decisions. Investors may irrationally cling to underperforming assets, hoping to break even, rather than reallocating their resources to more promising ventures. This behavior can result in significant missed opportunities and financial losses over time.

To illustrate the significance of loss aversion, let’s take a look at a simple table comparing the emotional responses to gains versus losses:

| Outcome | Emotional Response |

|---|---|

| Gain of $100 | Moderate Happiness |

| Loss of $100 | Significant Disappointment |

As we can see, the emotional impact of a loss is disproportionately greater than that of a gain. This fundamental understanding of loss aversion is crucial for anyone looking to navigate the complex landscape of decision-making, whether in personal finance, marketing, or behavioral economics.

In conclusion, loss aversion is not just a quirky psychological phenomenon; it’s a powerful force that shapes our choices and behaviors. By recognizing and understanding this bias, we can make more informed decisions, whether we’re investing in the stock market or simply shopping for groceries.

Applications in Marketing

Understanding loss aversion has become a game-changer for marketers looking to influence consumer behavior effectively. By recognizing that people are more motivated by the fear of losing something than by the potential for gain, marketers can tailor their strategies to highlight the risks of inaction. For instance, consider a scenario where a company launches a new product. Instead of simply promoting the benefits, they might emphasize what consumers stand to lose by not purchasing it. This approach taps into the emotional aspect of decision-making, making it far more compelling.

One common tactic employed in marketing is the use of limited-time offers. Shoppers often feel a sense of urgency when they believe a deal might slip through their fingers. For example, if a retailer advertises a 20% discount that expires in 48 hours, the fear of missing out (FOMO) can drive consumers to act quickly. This is a classic illustration of how loss aversion can be harnessed to boost sales.

Moreover, marketers frequently use social proof to leverage loss aversion. By showcasing testimonials or reviews that highlight what others gained by using a product, they subtly imply that not using the product could lead to missing out on similar benefits. This strategy not only enhances credibility but also reinforces the idea that consumers might lose out on valuable experiences if they don't take action.

Additionally, the concept of anchoring plays a crucial role in marketing strategies. By presenting a higher-priced item next to a discounted one, marketers create a perception of value that can lead consumers to make quicker purchasing decisions. The initial price serves as an anchor, making the discounted price appear as a significant loss avoided. This technique is often seen in retail settings where products are strategically placed to maximize visibility and perceived value.

To summarize, the applications of loss aversion in marketing extend beyond simple price reductions. Marketers can utilize various strategies to shape consumer perceptions and drive purchasing behavior. Here’s a quick overview of some effective applications:

- Urgency and Scarcity: Creating limited-time offers to prompt immediate action.

- Social Proof: Leveraging testimonials to highlight potential losses from inaction.

- Anchoring: Presenting higher-priced items to enhance perceived value of discounted products.

By integrating these principles into their marketing strategies, businesses can create compelling narratives that resonate with consumers on an emotional level. The key takeaway is that understanding the psychological underpinnings of decision-making, particularly through the lens of loss aversion, can significantly enhance marketing effectiveness and ultimately lead to increased sales.

- What is loss aversion? Loss aversion is a concept in behavioral economics that suggests people prefer to avoid losses rather than acquiring equivalent gains.

- How can marketers use loss aversion? Marketers can highlight potential losses that consumers may face if they don’t take action, such as missing out on a limited-time offer.

- What are some examples of loss aversion in marketing? Examples include limited-time sales, emphasizing customer testimonials, and using price anchoring techniques.

- Why is understanding consumer psychology important in marketing? Understanding consumer psychology helps marketers craft messages that resonate more deeply, leading to better engagement and higher conversion rates.

Impacts on Financial Decisions

The concept of loss aversion plays a pivotal role in shaping financial decisions, often leading investors to make choices that are not in their best interest. Imagine standing at a crossroads where one path promises a gain, and the other, a loss. Kahneman's research reveals that most individuals will avoid the path that may lead to a loss, even if the potential gain is significantly higher. This tendency can create a ripple effect in financial markets, where fear of loss outweighs the desire for profit, causing investors to hold onto underperforming assets far too long.

One striking illustration of this phenomenon can be seen in the behavior of investors during market downturns. When stock prices begin to fall, the instinctual reaction is often to hold onto those stocks, hoping they will rebound. This is not just a personal feeling; it’s a cognitive bias at work. A recent study indicated that about 60% of investors would rather endure a small loss than realize a larger one, demonstrating the profound impact of loss aversion on financial behavior.

Moreover, loss aversion can lead to what is known as the disposition effect, where investors are more likely to sell winning investments too early while holding onto losing ones for too long. This behavior can be detrimental, especially in volatile markets, where timing is crucial. To illustrate this, let's consider a simple table that summarizes the disposition effect:

| Investment Outcome | Investor Behavior |

|---|---|

| Winning Investment | Sell early to lock in profits |

| Losing Investment | Hold on, hoping for a recovery |

This table starkly highlights how loss aversion can skew rational decision-making. As investors cling to the hope of recovery, they may miss out on opportunities to reinvest in more promising ventures. Additionally, the emotional toll of this bias can lead to increased stress and anxiety, further clouding judgment and leading to poor financial choices.

Furthermore, the impacts of loss aversion extend beyond individual investors to the broader financial market. When a significant number of investors react similarly, it can lead to market inefficiencies and bubbles. For instance, during the dot-com bubble, many investors held onto their stocks despite clear signs of overvaluation, driven by the fear of loss and the hope of future gains. Such collective behavior can exacerbate market fluctuations, ultimately leading to more pronounced crashes and recoveries.

In conclusion, understanding the impacts of loss aversion on financial decisions is crucial for both individual investors and market analysts. By recognizing this bias, investors can strive to make more informed decisions, potentially leading to improved financial outcomes. The key lies in balancing emotional responses with rational analysis, ensuring that decisions are based on sound principles rather than fear of loss.

- What is loss aversion?

Loss aversion refers to the psychological phenomenon where individuals prefer to avoid losses rather than acquiring equivalent gains. This means that the pain of losing is psychologically more impactful than the pleasure of gaining. - How does loss aversion affect investment decisions?

Loss aversion can lead investors to hold onto losing investments longer than they should, hoping for a recovery, while selling winning investments too early, which can hinder overall portfolio performance. - What is the disposition effect?

The disposition effect is the tendency of investors to sell assets that have increased in value while keeping assets that have dropped in value, often due to loss aversion. - How can investors mitigate the effects of loss aversion?

Investors can mitigate loss aversion by setting clear investment goals, employing stop-loss orders, and maintaining a disciplined investment strategy that focuses on long-term outcomes rather than short-term fluctuations.

Framing Effects

Have you ever noticed how the same information can lead to completely different decisions depending on how it's presented? This phenomenon, known as , is a cornerstone of Daniel Kahneman's research in behavioral economics. It illustrates that our choices are not solely based on the information itself, but significantly influenced by the context in which that information is delivered. For instance, consider a medical treatment that has a 90% success rate versus one that has a 10% failure rate. Even though the statistics are identical, the way they are framed can lead to vastly different emotional responses and decision-making processes.

Kahneman and his colleague, Amos Tversky, conducted experiments that revealed how people tend to react differently to equivalent scenarios depending on whether they are framed in terms of potential gains or potential losses. This insight is crucial for understanding human behavior in economic contexts. When faced with a decision, individuals often evaluate the potential outcomes based on the way the options are presented. For example, if a marketing campaign emphasizes the benefits of a product, consumers are likely to perceive it more positively than if the same product is framed around what they might lose by not purchasing it.

To illustrate this further, let's look at a simple table that summarizes how different framings can impact decision-making:

| Framing | Example | Potential Decision |

|---|---|---|

| Positive Framing | “You will save $20 with this discount!” | Purchase the item |

| Negative Framing | “You will lose $20 if you don’t act now!” | Purchase the item |

In both cases, the decision to purchase is influenced by the framing. While the outcome is the same, the emotional appeal and perception of risk can vary significantly. This is particularly relevant in fields like marketing, finance, and public policy, where the stakes can be high, and the right framing can lead to more favorable outcomes.

Moreover, framing effects extend beyond simple marketing tactics; they can shape our understanding of critical issues such as health, safety, and environmental concerns. For example, when discussing climate change, presenting the issue as a threat to future generations can elicit a different response compared to framing it as an immediate risk to current lifestyles. This highlights the power of language and context in shaping public perception and action.

Understanding framing effects not only allows businesses to tailor their messages for maximum impact but also empowers consumers to recognize when they might be swayed by presentation rather than substance. By becoming aware of these biases, individuals can strive to make more informed decisions, leading to better outcomes in both personal and professional realms.

In conclusion, framing effects are a fascinating aspect of human psychology that underscores the complexity of decision-making. By examining how information is presented, we can gain valuable insights into the motivations behind our choices and the potential for manipulation in various contexts.

- What are framing effects? Framing effects refer to the way information is presented, which can influence decision-making and perceptions of risk and reward.

- How do framing effects impact consumer behavior? Consumers may react differently to the same product based on whether the marketing emphasizes gains or losses, affecting their purchasing decisions.

- Can framing effects be used ethically? Yes, while they can be used to influence behavior, ethical considerations should guide how information is framed to avoid manipulation.

- How can I recognize framing effects in my own decision-making? Being aware of how information is presented and questioning whether it affects your perception can help mitigate the influence of framing.

Overconfidence Bias

Overconfidence bias is a fascinating and often misunderstood phenomenon that affects individuals across various domains, from everyday life to high-stakes business decisions. At its core, this bias leads people to overestimate their knowledge, skills, and abilities. Imagine you're at a trivia night with friends, and you confidently declare that you know the answer to every question, only to find out that you were wrong more often than right. This is a classic example of overconfidence in action. It’s not just limited to casual settings; this bias can have profound implications in the world of business and economics.

In the realm of entrepreneurship, overconfidence can be particularly dangerous. Entrepreneurs often believe they have a unique insight into market trends or consumer behavior, which can lead to misguided strategies and poor decision-making. For instance, a startup founder might overestimate the demand for their product, leading them to invest heavily in production before validating their assumptions. This overconfidence can result in significant financial losses and, in some cases, the failure of the business altogether.

Moreover, overconfidence bias can skew economic forecasts. Analysts may project overly optimistic growth rates based on their past successes, ignoring potential risks and uncertainties. This can create a misleading sense of security, both for investors and the broader market. As we’ve seen in various economic downturns, a collective overconfidence can lead to bubbles that eventually burst, causing widespread financial turmoil.

To illustrate the impact of overconfidence bias, consider the following table that summarizes some common areas where this bias manifests:

| Area | Description | Potential Consequences |

|---|---|---|

| Entrepreneurship | Startups often overestimate market demand. | Financial losses, business failure. |

| Investment | Investors believe they can predict market movements. | Loss of capital, missed opportunities. |

| Economic Forecasting | Analysts project unrealistic growth rates. | Market bubbles, economic downturns. |

So, how can individuals and organizations mitigate the effects of overconfidence bias? Recognizing that this bias exists is the first step. Encouraging a culture of feedback and open dialogue can help ground decision-making in reality. For example, entrepreneurs should seek input from mentors or industry experts before making significant investments. Additionally, employing analytical tools and data-driven approaches can provide a more objective view of potential outcomes.

Ultimately, while confidence is essential for success, it’s crucial to balance it with a healthy dose of skepticism. By doing so, individuals can make more informed decisions that lead to sustainable growth and success, rather than falling prey to the pitfalls of overconfidence.

Q: What is overconfidence bias?

A: Overconfidence bias is the tendency for individuals to overestimate their knowledge and abilities, often leading to poor decision-making.

Q: How does overconfidence bias affect entrepreneurs?

A: It can lead entrepreneurs to misjudge market demand and make risky business decisions that could result in financial losses.

Q: Can overconfidence bias impact economic forecasts?

A: Yes, analysts may project overly optimistic growth rates, which can create misleading expectations and contribute to market instability.

Q: How can one mitigate overconfidence bias?

A: Recognizing the bias, seeking external feedback, and using data-driven decision-making can help mitigate its effects.

Implications for Entrepreneurs

Entrepreneurship is often hailed as the backbone of innovation and economic growth, but it’s a double-edged sword. With the thrill of launching a new venture comes the peril of overconfidence bias, a phenomenon that can significantly skew risk assessments and strategic decisions. Imagine a captain steering a ship through stormy waters; if he believes he can navigate through any tempest without a map, he might just find himself capsizing. This analogy perfectly encapsulates the plight of many entrepreneurs who, fueled by their self-assuredness, may overlook potential pitfalls.

Overconfidence can lead entrepreneurs to underestimate challenges, overestimate their knowledge, and misjudge the competitive landscape. For instance, a startup founder might believe their product is so groundbreaking that they disregard market research, assuming that customers will flock to them without question. This can result in a disconnect between the entrepreneur's vision and the actual market demand, leading to costly missteps. Furthermore, when entrepreneurs are overly confident, they may also neglect to build a robust team or seek advice from mentors, believing they can do it all alone. This isolation can stifle growth and innovation.

However, it’s not all doom and gloom. Recognizing the implications of overconfidence is the first step toward mitigating its effects. Entrepreneurs can adopt several strategies to balance their confidence with a healthy dose of caution. For example, they can:

- Engage in regular self-reflection to assess their decisions and motivations.

- Seek feedback from a diverse group of advisors to gain different perspectives.

- Conduct thorough market research and validate their ideas before launching.

By integrating these practices, entrepreneurs can cultivate a mindset that embraces both confidence and realism. This balance is crucial—not only for making sound business decisions but also for fostering a culture of collaboration and learning within their teams. After all, in the world of entrepreneurship, it’s not just about having the best idea; it’s about executing it wisely and adapting to the ever-changing landscape.

In conclusion, while overconfidence can propel entrepreneurs to take bold steps, it is essential to remain grounded in reality. The most successful entrepreneurs are those who can harness their passion and vision while also being open to feedback and willing to adjust their course as needed. By doing so, they can navigate their entrepreneurial journeys with both ambition and prudence, ultimately leading to sustainable success.

Q1: How can entrepreneurs identify their overconfidence bias?

A1: Entrepreneurs can identify their overconfidence bias by seeking feedback from peers, conducting market research, and regularly reflecting on their decisions and outcomes.

Q2: What are some signs that an entrepreneur is being overconfident?

A2: Signs of overconfidence include dismissing feedback, underestimating competitors, and making decisions without adequate research or planning.

Q3: Why is it important for entrepreneurs to balance confidence with caution?

A3: Balancing confidence with caution helps entrepreneurs make informed decisions, avoid costly mistakes, and adapt to changing market conditions effectively.

Strategies to Mitigate Overconfidence

Overconfidence can be a double-edged sword. While a certain level of confidence is essential for success, unchecked overconfidence can lead to poor decision-making and risky ventures. So, how can we keep our confidence in check without stifling our ambition? Here are some effective strategies that can help mitigate overconfidence and promote more balanced decision-making.

First and foremost, embracing humility is crucial. Recognizing that we don’t have all the answers can be incredibly liberating. It opens the door to new information and perspectives that can enhance our decision-making process. Consider the wise words of Socrates: “The only true wisdom is in knowing you know nothing.” By adopting this mindset, we can foster a culture of continuous learning and improvement.

Another effective strategy is to seek feedback from peers. Engaging with colleagues or mentors who can provide constructive criticism can help us gain a clearer understanding of our capabilities and limitations. This feedback loop is invaluable, as it encourages us to question our assumptions and consider alternative viewpoints. In fact, studies have shown that teams that regularly solicit feedback make better decisions than those that don’t. So, don’t shy away from asking for input!

Additionally, implementing a decision-making framework can be a game-changer. By establishing clear criteria for evaluating options, we can reduce the influence of overconfidence on our choices. For instance, using a weighted decision matrix allows us to objectively assess different factors and prioritize them based on their importance. This structured approach not only curbs impulsive decisions but also enhances the overall quality of our choices.

Moreover, it's essential to conduct pre-mortem analyses. This technique involves imagining that a project has failed and then working backward to identify potential reasons for that failure. By anticipating obstacles, we can prepare ourselves better and avoid the pitfalls of overconfidence. This proactive approach encourages critical thinking and helps us develop contingency plans, ultimately leading to more informed decision-making.

Finally, fostering a culture of accountability is vital. When individuals are held accountable for their decisions, they are less likely to act on overconfidence alone. Creating an environment where team members can discuss their thought processes openly and share their reasoning promotes transparency and collective ownership of decisions. This not only mitigates individual overconfidence but also enhances team dynamics.

In summary, while confidence is a key ingredient for success, it’s essential to balance it with humility, feedback, structured frameworks, pre-mortem analyses, and accountability. By employing these strategies, we can navigate the complexities of decision-making with greater clarity and effectiveness, ultimately leading to better outcomes. Remember, it’s not about eliminating confidence; it’s about harnessing it wisely.

- What is overconfidence bias?

Overconfidence bias refers to the tendency of individuals to overestimate their knowledge, abilities, and the accuracy of their predictions. - How does overconfidence affect decision-making?

Overconfidence can lead to risky decisions, as individuals may underestimate potential challenges and overestimate their likelihood of success. - Can overconfidence be beneficial?

Yes, a certain level of confidence can motivate individuals to take risks and pursue goals, but it must be balanced with self-awareness and critical thinking. - What are some signs of overconfidence?

Signs include dismissing feedback, making decisions without sufficient information, and underestimating risks.

Frequently Asked Questions

- What are cognitive biases, and how do they affect decision-making?

Cognitive biases are systematic patterns that deviate from rational judgment. They can lead us to make decisions based on emotions or flawed reasoning rather than objective facts. For instance, when we favor information that confirms our existing beliefs, we may overlook critical data that contradicts them, ultimately impacting economic choices.

- Can you explain Prospect Theory in simple terms?

Absolutely! Prospect Theory, developed by Kahneman and Tversky, describes how people make decisions when faced with risk. Unlike traditional utility theory, which assumes that people always act rationally, Prospect Theory suggests that people value gains and losses differently. Essentially, the pain of losing is often greater than the pleasure of gaining the same amount, which can lead to risk-averse behavior.

- What is loss aversion and why is it important?

Loss aversion is the concept that losses have a more significant emotional impact than equivalent gains. This means that losing $100 feels worse than gaining $100 feels good. Understanding this can help marketers and investors craft strategies that minimize perceived losses, ultimately influencing consumer behavior and investment decisions.

- How do framing effects influence our choices?

Framing effects refer to how the presentation of information can alter our perceptions and decisions. For example, if a medical treatment is described as having a 90% success rate versus a 10% failure rate, people are more likely to choose it based on the positive framing. This shows how context matters in decision-making and can lead us to make different choices based on how information is presented.

- What is overconfidence bias and its implications?

Overconfidence bias is when individuals overestimate their knowledge, skills, or control over outcomes. This can lead to poor business decisions and unrealistic economic forecasts. For entrepreneurs, this might mean taking on more risk than is prudent, potentially jeopardizing their ventures. Recognizing this bias is key to making more informed decisions.

- What strategies can help mitigate overconfidence?

To counteract overconfidence, individuals can seek feedback from others, conduct thorough research, and consider alternative viewpoints. By fostering a culture of openness and critical thinking, entrepreneurs can balance their confidence with caution, leading to more realistic assessments of risks and opportunities.